The Clear-Cut Guidebook On Opting For The Perfect Wide Range Monitoring Consultant

Created By-Silver Monroe

As you navigate the elaborate landscape of wide range management advisors, one important facet typically ignored is the value of establishing a solid rapport with your chosen consultant. Constructing a strong relationship goes beyond plain economic deals; it entails trust fund, interaction, and alignment of values. The foundation of this partnership can significantly impact the success of your financial objectives and the overall monitoring of your riches. So, just how can you cultivate this crucial bond with your expert?

Recognizing Your Financial Goals

To set a strong structure for your financial journey, clearly specify your wide range objectives. Begin by reviewing what you aspire to achieve financially. Do you intend to retire early, purchase a second home, or money your youngster's education and learning? Determining https://m.economictimes.com/wealth/invest/have-you-invested-a-lot-of-money-into-stocks-4-tips-to-manage-stock-market-volatility/articleshow/104955959.cms will certainly direct your wide range management choices and aid you stay concentrated on what absolutely matters to you.

Take into consideration both short-term and long-lasting objectives when detailing your economic goals. Short-term goals might include building a reserve, paying off debt, or saving for a vacation. On the other hand, long-lasting objectives could include investing for retired life, developing a tradition for your liked ones, or accomplishing financial independence. By distinguishing between these 2 groups, you can prioritize your purposes effectively.

In addition, make sure your wide range goals are realistic and quantifiable. Set clear targets with timelines connected to check your progress along the way. Remember, your monetary objectives are personal to you, so guarantee they straighten with your worths and goals. By recognizing your financial objectives, you're taking the crucial very first step in the direction of safeguarding your monetary future.

Assessing Consultant Certifications

When picking a wealth management expert, analyze their certifications to guarantee they align with your monetary goals and goals. Seek advisors with relevant qualifications such as Licensed Monetary Coordinator (CFP), Chartered Financial Expert (CFA), or Licensed Financial Investment Management Analyst (CIMA). These designations show that the expert has actually met details education and learning and experience needs, demonstrating a dedication to expert quality.

Additionally, think about the advisor's experience in the market and their track record of effectively handling clients' wide range. A seasoned advisor that's browsed numerous market problems can use useful insights and approaches to aid you achieve your monetary objectives.

It's also necessary to examine the expert's method to wealth monitoring. Some experts may focus on certain locations like retirement planning, estate preparation, or investment monitoring. Make https://postheaven.net/venus32roselle/creating-a-goal-oriented-financial-plan-a-practical-overview that their knowledge lines up with your needs. Moreover, ask about their financial investment viewpoint and exactly how they customize their approaches to satisfy customers' private scenarios.

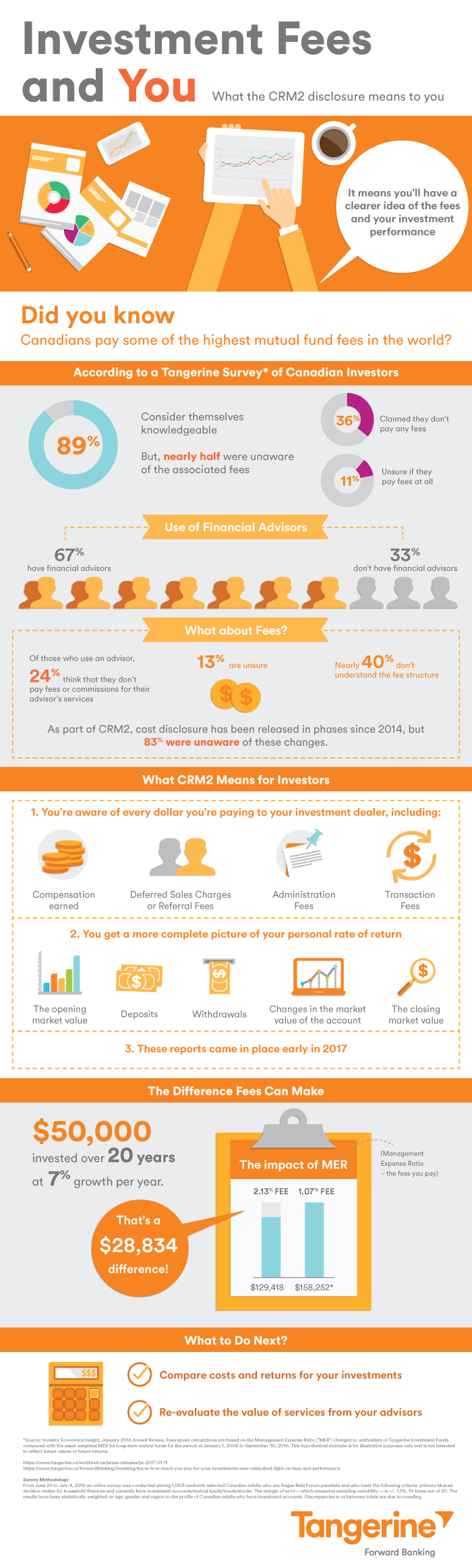

Comparing Fee Structures

Wondering how various wealth administration advisors structure their costs can assist you make an educated decision regarding that to select for your financial requirements.

When contrasting charge frameworks, consider whether the advisor charges a portion of possessions under management (AUM), a hourly price, a flat fee, or a combination of these. Advisors charging a percentage of AUM commonly take a percentage of the complete assets they manage for you, making their fees proportionate to your wealth.

Hourly prices are based upon the time the expert spends on your monetary matters. Apartment fees are dealt with expenses despite the assets took care of. https://fatima-forest6waldo.technetbloggers.de/exactly-how-to-produce-a-financial-strategy-that-straightens-with-your-objectives may provide a tiered cost framework where the percentage reduces as your possessions increase.

In addition, look out for any type of covert costs or commissions that can affect your overall returns. By comprehending and contrasting charge structures, you can pick a wide range management consultant whose pricing lines up with your monetary goals and choices.

Conclusion

In conclusion, by clearly defining your monetary goals, assessing consultant credentials, and contrasting cost frameworks, you can make an informed choice when choosing the appropriate riches administration consultant.

Keep in mind to prioritize your desires, consider your goals, and make certain that the advisor's approach aligns with your needs.

With careful consideration and study, you can discover an advisor who'll help you achieve your monetary objectives and safeguard your monetary future.